Know All About Chart of Accounts: Essential of COA in UAE Companies

What is Meant by a Chart of Accounts?

A chart of accounts (COA) is a detailed data list that is used to record the transactional history of a company. This data is used to audit the overall performance and make huge changes in company strategy. Which is also an essential part of the accounting and financial services of a company

How does a chart of accounts work?

Chart of accounts completely working on the data metrics of a company, which is a specially monitored system that can store every minute of data in several categories. All finance management companies prefer to build a chart of accounts to run a detailed analysis and to improve their economic strength.

Structure of COA

The working method of a chart of account has been classified into 5 categories:

- Assets: What the business owns (cash, computers, buildings).

- Liabilities: What the business owes (loans, bills).

- Equity: The owner’s share in the business.

- Revenue: Money the business earns (sales).

- Expenses: Money the business spends (rent, salaries).

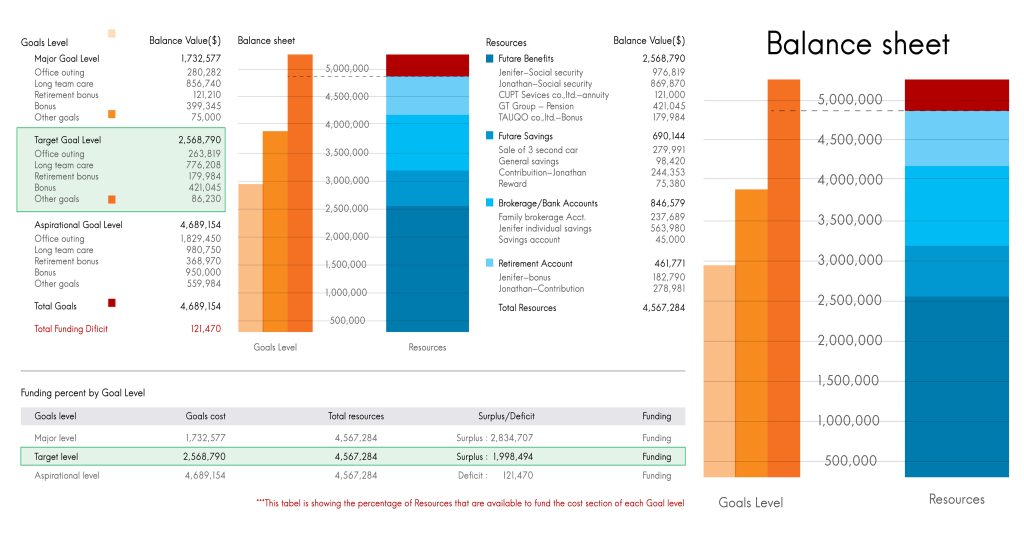

This information is used to create financial reports:

- Balance Sheet: Shows what the business owns and owes at a specific time.

- Income Statement: Shows how much money the business made or lost over a period.

- MIS Report : Shows a summary of important information to help the business to make better decisions for their future growth.

- Audit Report : Shows the complete data about the company’s transactions after a detailed audit

Understanding the Basics of COA

The COA meaning is simple: it’s like a list of all the different ways a business deals with money. To define account in accounting, think of each thing on that list as a special place to keep track of a certain kind of money activity. For example, “Cash we have” is an account, “Money people owe us” is another, and “Money we pay for rent” is another. Knowing what the COA meaning is and what each account meaning in accounting is helps you use the chart of accounts right.

Why is a chart of accounts important for business in the UAE?

Chart of accounts is not only important in the UAE; it is essential in all businesses that deal with financial transactions to monitor the growth and help to avoid legal issues and huge financial crises. It helps to know how the business is doing with the transactions. If you don’t have a good chart of accounts list, it’s hard to know the transactional history. This makes it tough to make decisions for your business. The chart of accounts is the key of to the company’s accounting and bookkeeping.

Know more about your business transaction: The chart of accounts

A chart of accounts is like a special list that helps your business keep track of all its money. It puts everything into different boxes so you know what you own, what you owe, and how much money is coming in and going out. It’s a really important tool for understanding your business’s finances.

What’s in a Chart of Accounts List?

Here’s the example:

The chart of accounts list has different groups.

These fundamental categories—assets, liabilities, equity, revenue, and expenses—form the backbone of the chart of accounts, with each category and its specific components assigned numerical codes for straightforward identification and tracking within the financial records.

Why is a chart of accounts important?

Knowing why a chart of accounts is important is simple. It helps you see the big picture of your business’s money. With a good chart of accounts, you can easily create reports that show how your business is doing. For example, reports like the balance sheet (showing what you own and owe) and the income statement (showing if you made or lost money). This helps you make smart choices for your business.

Account Ledgers

For each thing listed in your chart of accounts, there’s often a more detailed record called an account ledger. The account ledger shows every single time money came into or went out of that specific account. For example, the expense account ledger will show all the times you paid for things like rent or supplies. Similarly, the revenue account ledger will show all the money you earned from sales. These ledgers give you a closer look at each part of your business’s money.

Experience Seamless transactional history

By admitting a chart of accounts in your financial asset management system, you can experience the best record keeping for analysis and increase the company’s growth and help you keep great records to understand your business better and grow it.

FAQS

A chart of accounts is important in every business sector to understand the business growth and track the transactional history, which also helps you in:

Keeps money organized: It gives every type of money in your business a clear home, so nothing gets lost.

Shows true business health: Helps you quickly see if you’re making money, what you own, and what you owe.

Makes reports simple: Creating financial reports, like showing your profits, becomes quick and easy.

Easier taxes & checks: Organized records mean less stress when dealing with taxes or official reviews.

Helps make smart decisions: You can easily spot where money is going and what’s doing well.

A chart of accounts (COA) is simply a complete list of all the categories your business uses to keep track of its transactions. It’s like an organized index where every financial transaction gets its own specific labeled slot, usually with a unique number.

You make a chart of accounts by listing all the ways your business spends and earns money and what it owns and owes.

- Group your money. Start with five main types:

- Assets: What you own (cash, equipment).

- Liabilities: What you owe (loans, bills).

- Equity: Owner’s investment.

- Revenue: Money earned from sales.

- Expenses: Money spent to run the business.

- List specific items: Under each group, add detailed accounts like “Bank Account,” “Rent Expense,” or “Sales.”

- Give them numbers. Assign a unique number to each account for easy tracking (e.g., 1000 for cash, 5000 for rent).

To export your Chart of Accounts from QuickBooks Online, log in and navigate to the Accounting section, then select Chart of Accounts. Once there, click Run Report. You’ll then see an Export icon (often a small box with an arrow) in the top right, which lets you download your data as an Excel or PDF file. For further assistance with your accounting needs, please reach out to MNK Audit.